irvine ca income tax rate

Sales Tax State Local Sales Tax on Food. Sales Tax State Local Sales Tax on Food.

These 7 U S States Have No Income Tax The Motley Fool Income Tax Map Amazing Maps

10 rows Sales Tax.

. California income tax rate. The average cumulative sales tax rate in Irvine California is 775. There is no applicable city tax.

See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Irvine CA. The state income tax rates range from 1 to 123 and the sales tax rate is 725 to 1075. Median household income in California.

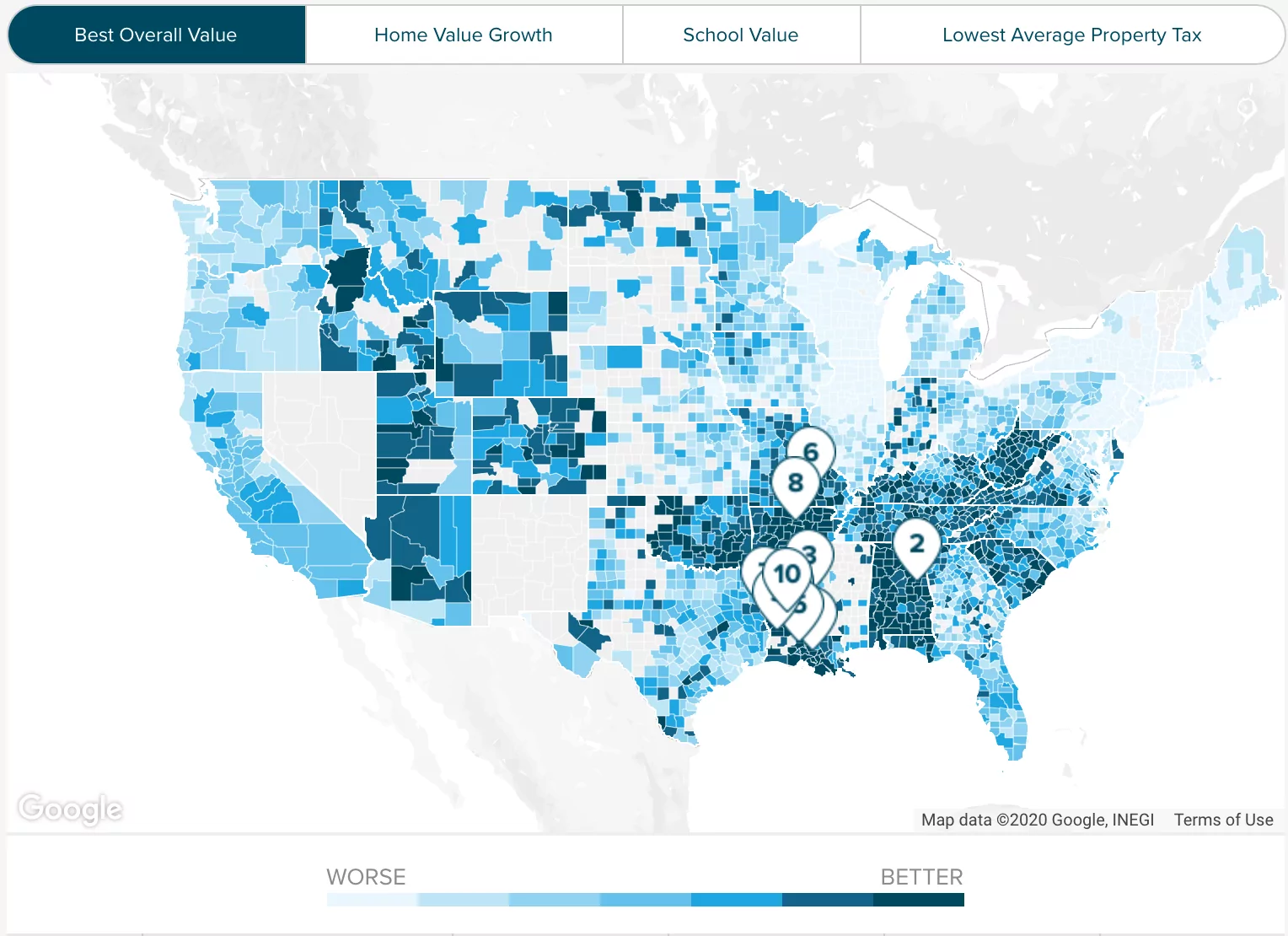

Carefully calculate your actual property tax including any exemptions that you are allowed to have. East Irvine Irvine 7750. Census Bureau Number of cities that have local income taxes.

The US average is 46. You can print a 775 sales tax. This is the total of state county and city sales tax rates.

The 775 sales tax rate in Irvine consists of 6 California state sales tax 025 Orange County sales tax and 15 Special tax. This includes the rates on the state county city and special levels. Taxes in Irvine California are 102 more expensive than Brea California.

The minimum combined 2022 sales tax rate for Irvine California is. Real property tax on median home. California state offers tax deductions and credits to reduce your tax liability including a.

East Lynwood Lynwood 10250. Irvine City Sales Tax. East Palo Alto 9875.

Irvine is located within Orange. What is the sales tax rate in Irvine California. Cost of Living Indexes.

Realistic real estate value appreciation will not increase your yearly bill sufficiently to justify a. - Tax Rates can have a. 30 rows - The Income Tax Rate for Irvine is 93.

Our CFO and Accounting firm is located at 17575 Harvard Ave C740 in Irvine CA. Real property tax on median home. The state income tax rates range from 1 to 123 and the sales tax rate is 725 to 1075.

Orange County Sales Tax.

What Are Salary Taxes For Software Engineers In The Usa Quora

Tax Rates And Income Brackets For 2020

What Is The Tax Rate In Sunnyvale California How Much Would I Get Per Month After Taxes If My Salary Is 85000 Quora

How To Fill Out Your W 4 Form In 2022 Tax Forms W4 Tax Form Form

Study Reveals Most Least Tax Friendly States How California Compares Ktla

Calif Business Owners Pay Highest Income Tax Rate Orange County Register

California Paycheck Calculator Smartasset

Understanding California S Property Taxes

Winter 2021 Canadian Income Tax Highlights Cardinal Point Wealth Management

Non Prime Financing 500 Fico 1 Day Out Of Bankruptcy Foreclosure Or Short Sale Bank Statement Program Availab Commercial Loans Usda Loan Mortgage Companies

Why Households Need 300 000 To Live A Middle Class Lifestyle

Orange County Ca Property Tax Calculator Smartasset

Income Tax Preparation Chicago Accounting Services Of High Quality That Can Help You Handle Even The Most C Income Tax Preparation Tax Preparation Tax Attorney

Understanding California S Property Taxes

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Federal Income Tax

Ways To Save On Home Expenses Money Savvy Ways To Save Money Mindset

Multiple Property Financing Commercial Loans Mortgage Companies Usda Loan